6 Trends Driving The Baby Boomers In 2024

Image Courtesy of @jaadiee

ARE BABY BOOMERS NOW THE FORGOTTEN GENERATION?

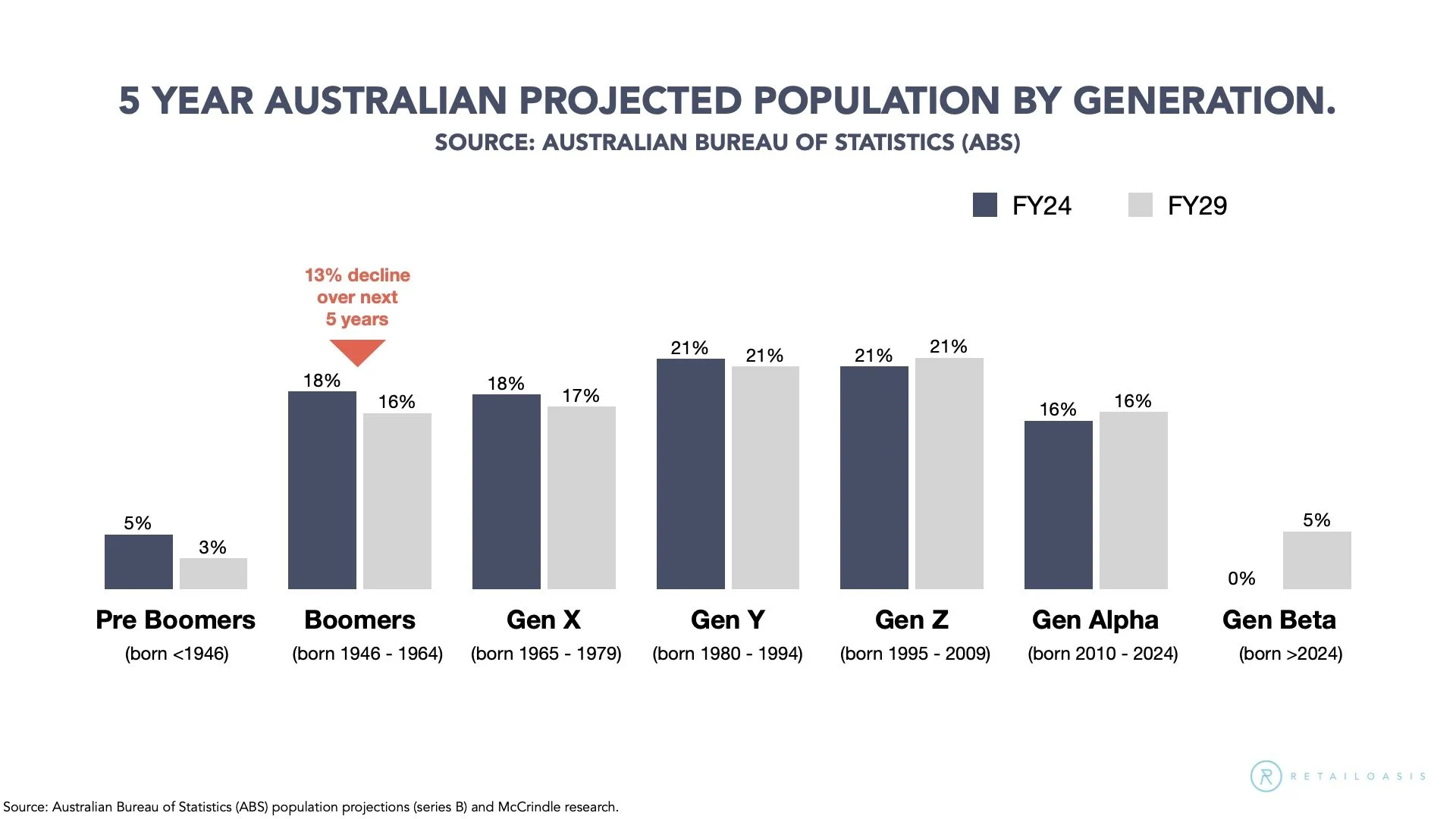

Over the last few years, retailers and brands have rushed to woo Millennial (30 – 44 years old) and Gen Z (14 – 29 years old) consumers. According to the latest ABS census projections, Millennials currently constitute the largest population cohort, with Gen Z poised to overtake them by 2027.

These digital native consumers, those individuals who have grown up with the presence of digital technology (typically Millennials or younger), will soon surpass those ‘digital immigrants’, those born before the widespread adoption of computers and have had to adopt to digital technology later in life (typically Gen X or older). As a result, a staggering 90% of all marketing spend is generally directed towards Millennials and their younger Gen Z counterparts.

Between the 80’s and 90’s, Baby Boomers (60 – 78 years old) dominated the market, making up anywhere between 34% - 40% of the total population here in Australia. Today they only make up approximately 19%, and in the next 5 years they’ll make up as little as 16%.

MAKING A CASE FOR THE BOOMER CONSUMER

When you look at Boomers spend across the retail sector it paints somewhat of a different picture. Despite their declining numbers, Boomers still wield significant economic power, controlling over half of Australia’s wealth. While Millennials and Gen Z’s have decades ahead to accumulate wealth, it’s improbable that Australia will witness a Boomer-like dominance again, where less than a fifth of the population controls over half of the total wealth in Australia.

Boomers have enjoyed nearly five decades of sustained economic growth, and their influence shows no signs of waning anytime soon. While Australia awaits one of its most significant intergenerational wealth transfers, this transition remains a distant prospect. In the meantime, Boomers maintain their status as the primary drivers of retail spending, a trend expected to persist for at least the next five years.

While Millennials and Gen Z are often touted as the future of retail, it’s essential not to overlook Boomers’ substantial contributions to consumer spending.

But why do we continue to disregard them as a demographic?

Today’s 60 to 78 year old’s are markedly different from their counterparts of years past. As we look ahead through 2024, it’s crucial to consider the trends shaping Boomer consumer behaviour and the categories they are likely to favour. And how retailers and brands can attract this declining, yet significant cohort.

WHAT KEY TRENDS DO WE SEE IMPACTING BOOMERS AND HOW WILL THEY SHOP IN 2024 (AND BEYOND)

1. Boomers might have been slow to adapt to online, but this is changing.

Boomers aren’t completely hopeless when it comes to online. Surprisingly, shoppers aged 65 and above represent the fastest-growing demographic when it comes to online. Contrary to stereotypes, Boomers spend an additional two hours on the internet daily compared to their Gen Z counterparts.

Their presence on social media is also increasing, with 108 minutes dedicated to social media platforms like Facebook, Instagram, and TikTok. With a growing interest in influencers who engage them on these platforms, we’re already starting to see a surge in social media influencers targeting this Boomer cohort.

While Millennials and Gen Z are the most frequent online shoppers, when they’re spending, Boomers boast generally one of the highest average basket sizes for online purchases.

While they may not embrace emojis like their grandchildren, it’s imperative for retailers to understand Boomers preferences when it comes to ecommerce.

2. Boomers seek exceptional customer service experiences.

When asked what their favourite brands do,

- 84% of Boomers said ‘treat them like individuals’.

- 80% said ‘strive to develop a relationship’.

- 71% said ‘make them feel special, like VIPs’.

Boomers crave amazing and personalised service, more than any other generation. And not just on the actual purchase, but post-purchase as well. We’re now starting to see more retailers pivot service options to specifically talk to Boomers – such as the introduction of ‘slow’ checkouts in supermarkets, which encourages customers to take their time and talk to staff.

In targeting Boomers, it is imperative that retailers provide amazing customer service not just in-store, but through online channels as well, with tech like personalisation and AI. They’re also the most intolerant generation when it comes to irrelevant content, so messaging and tone are crucial.

3. They’re the hardest generation to win over, but once you do, they’re a customer for life.

Boomers are extremely loyal. And when they become loyal to a brand, they tend to stay that way. Boomers are more likely to visit the store and websites they are already familiar with, particularly compared to younger generations. Only 20% of Boomers have switched away or became less loyal to a brand in the last year.

Boomers can be won through loyalty programs and trust. 65% of Boomers said that loyalty programs are important or critical to maintaining their loyalty.

So, if you don’t yet have a loyalty program, it’s time to consider one.

4. They’re seeking more ‘experiences’ and less products.

As Boomers continue to wield significant spending power, their consumer habits are evolving toward prioritising ‘experiences’ over material possessions.

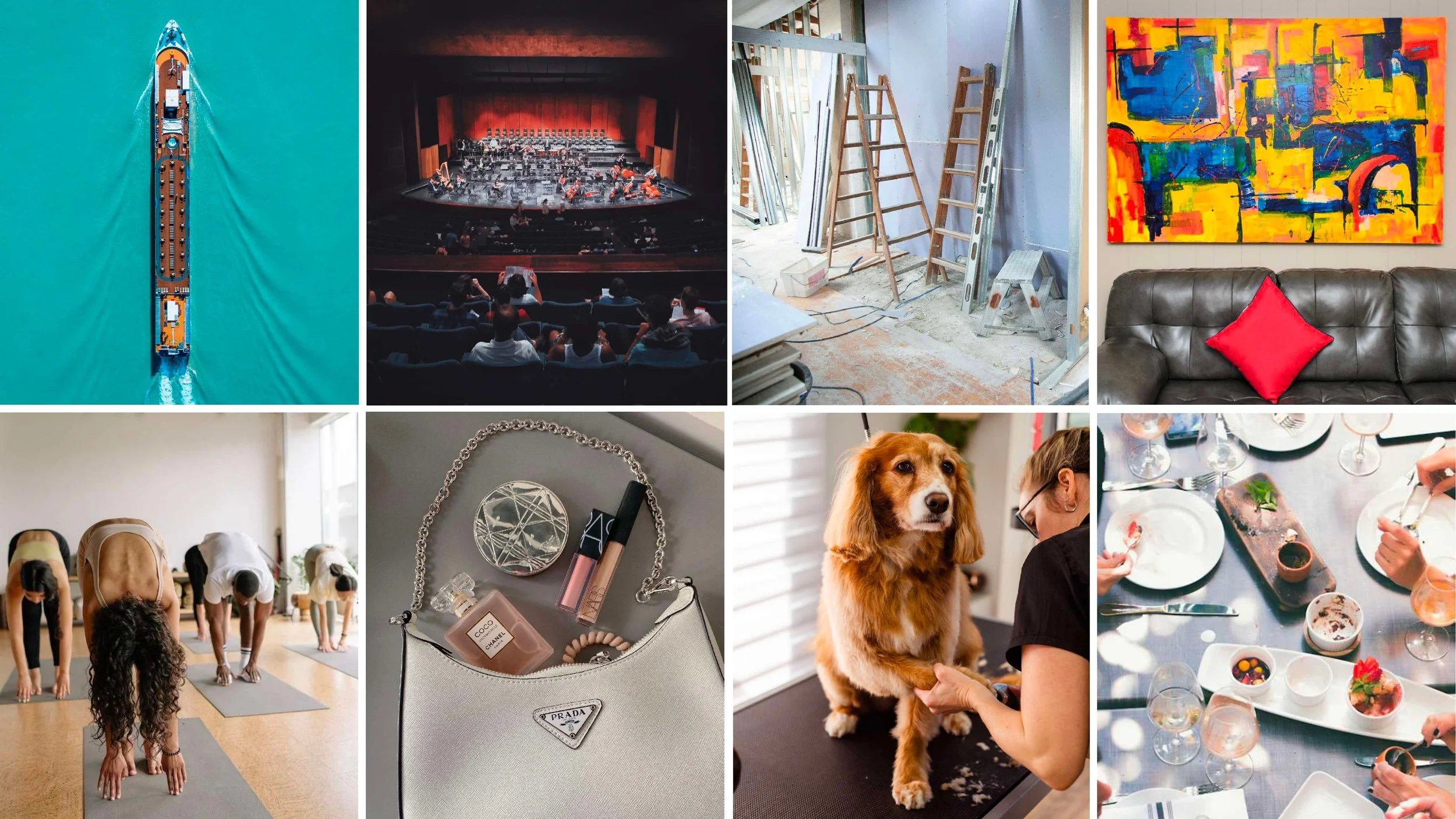

Just as the housing market soared when Boomers moved to the suburbs to raise their families, other sectors of the economy will do well as this segment moves into the next phase – retirement. With ample discretionary income, they’re inclined to invest in travel, entertainment, dining out, art, home improvement and even pets, seeking to enrich their lives post-retirement with meaningful experiences and new hobbies. In addition to these experiences, is luxury purchases. As older consumers are generally more financially stable, they tend to prioritise long-lasting, higher quality products over cheaper, disposable ones. Health and wellness will also take precedence for Boomers, with over half reporting of a long-term health condition.

Consequently, their spending patterns are veering away from traditional purchases such as clothing, sporting equipment, appliances, and homewares.

5. The future Boomer consumer will significantly skew female.

It’s a well-documented fact that women live longer than men, roughly about 3 – 5 years for a Boomer. And with the oldest Boomers soon approaching their 80s (close to the Australian average life expectancy), the front end of this segment will start to reach this unfortunate milestone in the next two years. This means that an even greater percentage of Boomers will be women.

In a practical sense, that means categories that traditionally bias towards males such as men’s clothing and accessories, automotive accessories, men’s grooming and sporting categories like golf gear etc will likely taper off among Boomers. Conversely, sales of women’s products and services will likely grow. Understanding this female Boomer mindset will become even more important.

6. Sustainability isn’t just a driver for Gen’s Y and Z.

While sustainability is increasingly a central concern for consumers, it’s noteworthy that older generations are more likely to lead by example. Despite media portrayals that highlight younger digital natives (Gen’s Y and Z) as the ‘green generation’, there’s a noticeable gap between attitudes and actions when it comes to sustainability. Research suggests that, in many instances, older demographics are actually ahead in adoption of sustainable practices.

Perceived cost barriers frequently discourage consumers from embracing sustainable choices, yet older generations typically possess greater financial resources to overcome these obstacles.

It’s crucial for retailers to articulate clear sustainability strategies that resonate across generational lines. Additionally, Boomers are particularly adept at identifying insincere or ‘greenwashing’ tactics, emphasising the importance of authenticity in sustainability initiatives.