SMH: ‘Retailers hanging tough but smaller brands at risk’

The original article which appeared on smh.com.au is available here.

written by Emma Koehn

Australia’s retailers are broadly tipped to escape the carnage sweeping across the construction sector as affluent consumers keep shopping, but experts warn that smaller brands and retailers selling big-ticket items and apparel could slip into the danger zone.

The recent spate of high-profile collapses in the building industry has once again put the spotlight on cost pressures on businesses across the economy, but retail analysts say consumer stocks are in a better than expected position.

March industry data from credit reporting agency CreditorWatch suggests that companies in the food and beverage and construction industry are among those most vulnerable to collapse, while retailers have a much lower probability of falling over. The rate of external administrations among retailers over the past 12 months has been just 0.46 per cent.

“They are faring quite well on a comparative basis ... although we know that can turn quite quickly,” CreditorWatch chief executive Patrick Coghlan said.

“You can look at retail the same way you would look at most industries in that those that have a strong balance sheet and access to capital are well positioned. Larger organisations in particular can deal with a downturn.”

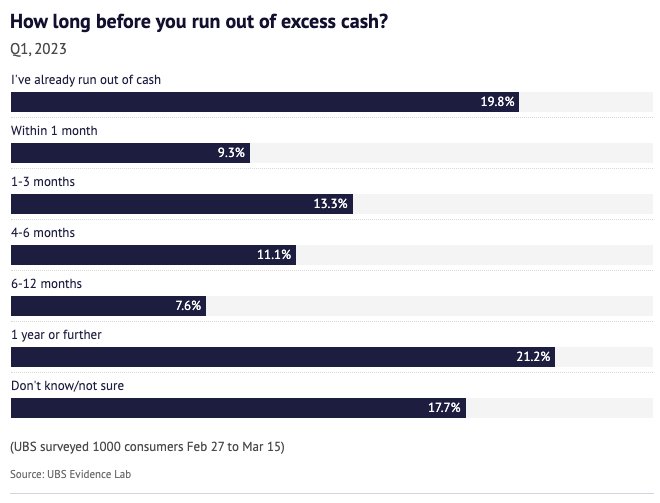

Analysts at investment bank UBS agree that the outlook is better than what some market watchers had been predicting, with the group’s most recent consumer survey showing shoppers overall are still upbeat about spending, even if momentum has slowed.

Wealthy consumers on salaries of more than $120,000 a year are the most optimistic and intend to continue spending on home maintenance and travel, which will help buoy the retail sector, UBS said.

Despite this, market watchers say mortgage and cost of living pressures on lower income households will continue to slow down sales of big ticket items, putting pressure on home goods businesses. UBS has a sell rating on electronics retailer Harvey Norman.

“Any retail categories tied to large one-off purchases or luxury are often the first to be impacted by rises in interest rates,” Retail Oasis co-director Trent Rigby said.

“We’ve already seen slowing sales from the likes of Temple and Webster, JB Hi-Fi, Harvey Norman and Adairs. With the housing category, you have the triple impact of reduced discretionary spend from consumers, but also higher interest rates slow the pace of new home builds and restricts the number of new homes coming onto the market.”

While consumers have spent big on fashion and apparel in the post-lockdown era, there are signs that spending is flattening in these categories. Clothing and footwear sales jumped by just 0.6 per cent in February, according to Australian Bureau of Statistics figures.

This has prompted caution among analysts about the strength of mid-market brands over the next few months. ASX-listed companies like City Chic, Best & Less and baby goods retailer Baby Bunting have all told investors over the past six months that conditions have been challenging.

Rigby says department stores may also face tough conditions as the gap between essential retail brands and those in discretionary spaces continues to widen.

Morningstar’s equities team is expecting demand for “nonessential” spending to deteriorate throughout the rest of this year, and notes that even the current share prices of some of the best performing retailers in the country might be too high.

“Demand for some categories, such as apparel and recreational goods, remain above pre-COVID-19 norms. Cyclical retailers Super Retail, Myer, and Premier Investments all screen as overvalued,” Morningstar said in a quarterly review of the retail sector.

No matter what they sell, smaller retailers are likely to face the biggest uphill battle when competing for consumers’ dollars.

“We’re seeing significant pressure at the moment across small and independent retailers, which we only expect to get worse in the likely event of another interest rate hike,” Rigby said.

“In addition to decreased consumer confidence, reduced spend and slower overall growth – smaller retailers have increased difficulty in forecasting inventory demand and ability to service debt.”

Coghlan agrees that in this environment, larger brands have the inherent advantage. “They are going to fare better than smaller businesses,” he said.